Borrow money easily with sms loans

SMS loans – more and more people are applying to borrow money over the net via what is called SMS loans. The name itself is no longer very relevant, but reflects that it was once in the same time that it borrowed this kind of unsecured loan – via SMS. Now it takes place in ninety cases of hundreds on your computer, smartphone or tablet.

Here on our website we strive to give you as good insight as possible in the best and most consumer-friendly SMS loans that are out there on the market. With our help you lend money easily with an SMS loan. To help you forward to such a good SMS loan as possible. Our website serves as what you could easily describe as a small guide to. All relevant about SMS loans and instant messages, etc.

Borrowing money without collateral through a SMS loan can be a right for a healthy experience for those who for various reasons come to associate it with borrowing money by going to the bank with the cap in hand, and beg and pray. When you borrow money through a SMS loan. It goes into a radically different way. We guarantee this.

The application itself is in itself almost by itself and the rest is a process that is characterized by going fast as well as smoothly and easily. Provided that you get your loan application approved rather than being refused. It goes quickly from the fact that the approval has gone through to you actually have the money you borrowed on your account. Sometimes it’s about a day’s wait. But it’s not unusual that you have the money in your account already on the same date.

SMS loans interest free

Is it a reality? An interest-free SMS loan? Actually, the answer to the question is – yes!

Applying for a quick and easy SMS loan involves several lenders that if you are new, i.e. if you are a first-time customer. You are offered to receive your SMS loan completely interest-free. All that usually involves you being expected to pay back within a limited period (not seldom thirty days) after you applied for your SMS loan. That said, this is no offer that is especially common. For anyone other than the one who takes a SMS loan for the first time. But whatever it is a good thing to keep in mind. However, it is rare that these interest-free (sometimes called the free) SMS loans apply especially large sums of money and the like. So if that’s what you’re after, it might not be your thing, after all.

If you are unsure if you will be able to pay back within the payback time span, we advise you to apply for a “standard” SMS loan. Instead of a free SMS loan. It is mostly for your own sake. Given that the interest rate can be expected to be real high for an interest-free SMS loan where the maturity has run out. After which the loan thus turned into a very highly interest-rate SMS loan. That said, if you suspect that this is likely to happen. We advise you to instead apply for a regular SMS unsecured loan with interest. Rather than the alternative free SMS loan.

Instant loan without income

A little exaggerated, you can describe SMS loans and instant cash credits that are directly adapted to a new time where the life situation is with great clarity radically different for many of today’s young people in comparison with their parents.

This does not necessarily mean that things have become worse. Far from it! Rather, it means that we live in a time where the labor market and other living conditions are in violent change. So fewer people for each passing year fit into the banks ‘ idea of how a perfect borrower looks like. More than ever studying. Working extra, attending temporary or freelancing. Thus, a discussion about applying for a fast-blow without income is very relevant.

Just the thing that you as a borrower of SMS loans can get your application approved even though you do not have a fixed monthly income, many consider to be quite unbelievable. In relation to the fact that it previously looked radically different out.

To borrow money from a bank, for example. Which is what the vast majority of peoples still associate with borrowing money in general, means that you are expected to present both a plan on what the money will be used for as a thorough account of your financial Background. Your working conditions, etc.

When you apply for an SMS loan or a quick sign (the same thing) you are expected as a borrower to pay back what you owe. The lender also wants you to be over eighteen years old and not late before has a lot of unpaid debts, which has led to problems with payment defaults, etc. Besides that, you have free rein to use the money you borrowed to just what you want.

If you are applying for an SMS loan or a fast bank without income, it doesn’t matter if you don’t have a steady flow of money that wraps up every month. Only you pay back. Are you a student and only live on your student loan? No problem whatsoever. Are you an artist and do you get paid maybe every three months when you sell a sculpture, rather than at the same date every month? No problem whatsoever.

More and more people are living under conditions where traditional life and working conditions no longer apply, which is not, however. Reflected at all in how the banks regard their requirements for those who wish to borrow money. There it is still closest to the breadwinner. Who is the norm and everything that falls outside is. Either just strangely overall. Or directly repreviously and certainly not worthy of being allowed to borrow any money.

As such, SMS loans have made entrance into Swpeoples ‘ lives at the right time. One could say. Sms loans are a unsecured loan for a new time and for a new kind of world.

Apply for a quick blow without income and it is quick and easy. There is no problem. Only you can pay back.

SMS loans best in test

Are there SMS loans that stand out something very special and which can thus be said to be in any sense best-in-test? Absolutely. And they are included in the list of great deals on loans that you can easily find here on our website, both here in the presentation text and in the separate articles. In the list we have not appointed a specific “winner” where is significantly better than any of the other offers of SMS loans and Miniloans.

However, every loan is raked to make it easier for you as a potential borrower to go through the list and find something that suits you and your needs in the best possible way.

Why is it difficult to appoint only one loan as the best? As undoubtedly best-in-test? It actually says itself, considering that every peoples needs and conditions and hopes. When borrowing money simply look radically different. Thus it is difficult to determine which SMS loan spans all categories and the home title is the undoubtedly best.

It’s simply not possible to fix it so we’re not even trying to tell you. Which SMS loan you should choose. We can guide you to the right SMS loans. Of course, but only indirectly and with great respect for your. Peculiarities and special needs, which only you and no one else know.

When discussing SMS loans and which should really be called the best, etc. There are always many factors to be taken into account in order to produce a result that says at all. And even under these conditions, it is given that a particularly credible result is produced, because (just as we have already touched on) it is about so much when trying to get and decide which SMS loan is really the best.

In addition, it happens that the market for SMS loans and mini-loans and instant credits is particularly prone to rapid throws and changes, which means that the determination of which loan is. In fact, the best is difficult to determine based on so incredibly many parameters. But we guarantee that you will find many good SMS loans in our list. No matter what it is you are looking for.

SMS loans direct

Something that attracts people to apply for SMS loan and instant loans is the directness. This applies to a greater extent than other factors, although they all play a role in a larger drama in which they all make SMS loans to something desirable for many people who need to borrow money. But that you can apply for a SMS loan directly and have the money just as directly on your bank account. It certainly means another step on the road to making an SMS loan to something that people would like to have. It’s just that.

Applying for your SMS loan is a simple and smooth process wherein you can expect to have access to your borrowed money just as easily and smoothly. Otherwise it is something that is not right. Remember that when you apply for a SMS loan without collateral. It is completely different terms and conditions that apply, and you can expect a process from the actual application for your SMS loan to ensure that you actually have the money you asked to dispose of how you want. Which is short and smooth and incredibly simple.

The idea of applying for a SMS loan was already from the very beginning great simplicity and directness. Therefore. Many people are searching online just after an SMS loan directly. Considering that this is just one of the most important factors in explaining SMS loan attractiveness.

There is a lot of negative you can say about SMS loans. Course! So is actually the case with most things in life, right? Despite this, there is a definite tendency to demonise SMS loans. Mini-loans and fast-moving beyond proportion and the media of the tabloids kind of excelles gladly in descriptions of how easy it is to be scammed and get sky-high interest rates on the neck, etc.

The truth is that Many unfortunately end up in economically problematic situations as a result of applying for one or more SMS loans, but often it is about individuals who, for various reasons, should have been more skeptical about taking loans from the outset and thus with a Some leverage can be said to have put themselves in a difficult situation.

We are pointing no fingers here. As there are also lots of examples where lenders of SMS loans and Miniloans were fumable and directly secretive with their terms which a few times had detrimental impact on their customers ‘ lives and finances. It is always a good idea to check the terms of your loan. Not bar once, or twice, but as many times as necessary to get you complete track of what the situation really looks like and thus avoid going on a SMS loan jaw slap.

Nobody wants to. Last but not least on this subject, we advise you never ever – under any circumstances – to apply for an SMS loan to pay off previously existing debts. It’s never a good idea and just can’t stop well. No matter how you go about it!

Compare SMS loans

How do you really know which SMS loan is the best? Which quick-blow is the best? There are so many lenders out there that with separating them can seem like a minor impossibility. Comparing SMS loans is not the simplest thing in the world. This is why we are here to help you on the way!

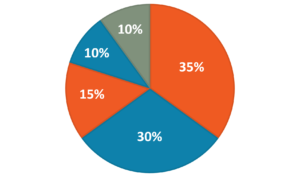

When you compare SMS loans and when you compare the instant messages. There are several things to consider. Without necessarily lining them up. Which in itself is an impossibility of a wide range of foundations. It is nevertheless worth highlighting some specific points that stand out on the cross.

Interest rate. Making sure to apply for a SMS loan with a favorable interest rate is always important. I do not necessarily think we need to tell you because you surely understand it anyway. The interest rate is clearly at different levels. Completely depending on who your lender is why it is always an excellent reason to compare SMS loans to find the best deal.

Generally, the interest rate is at a higher level than when you borrow money through a bank, for example. There are, of course. Dfferent reasons for this, but mainly it is that when you borrow money without collateral, your lender needs another method to secure that they will get the money you borrowed back. Therefore, the interest rate is simply higher. Just because the lender wants to make sure that they actually get the money they lent back. Speaking of it…

… Repayment. When it comes to this, lenders offer many different things. For some it is about the chance to repay for a period that spans several years. Sometimes it is a question of periods that are almost absurd, but after all. To set up a repayment plan that does not deplete your finances in the moment, while being effective enough to make you completely free of debt as quickly as possible… It is not always the simplest. Nevertheless, it is something you should strive for.

Specials. These include, for example, such things as 30 days of interest-free loans in case you are a first-time employee, or other similar offers. If you are applying for an SMS loan for the first time, this is absolutely worth keeping in mind. Be sure to have full control of what is being offered and maybe there is something that really makes you feel indebted for comparing SMS loans.

So what to choose?

Yes, that is not really a question we can give a straight and clear answer to, entirely based on the fact that the group of people who read this text represents something that is the exact opposite of a homogeneous group. The basics of needing long money swings from person to person, the work situation as well, and how the identity and the economic situation look like otherwise.

When it comes to SMS loans, we can not give you an answer to what you should choose and what you should not choose, etc. There is a person who knows what is best for you, and that is actually yourself. It’s not really anyone else who can tell you what you should do.

When you borrow money through an SMS loan, you move with more freedom than is the case almost everywhere else, all categories. This means, of course, a greater freedom of movement than you would otherwise be accustomed to if you have, for example, taken bank loans earlier, or similar.

There are, however, some difficulties, which we have to some extent touched upon. We always advise you to never borrow more money than you actually need, to carefully check out the terms and conditions of your loan before you actually apply for it and that you make sure to get yourself as good an overview as possible over your financial life situation. It’s not because we want to create paranoia inside you, rather it’s about trying to make sure you get as good an experience as possible.

And to get it, after all, an awareness is needed about what you really do when you borrow money. It’s just that. We are here for your sake.

The SMS loan you choose is the SMS loan that fits best based on your specific and unique life situation. Therefore, it is also extremely difficult for us to tell you exactly what, how and why things should go about in a certain way. That’s how it simply doesn’t work. It would have been a little easier if it looked like that. But it just doesn’t.

Thus, we present a lot of opportunities for those who are interested in applying for an SMS loan. But we never say that you should choose something specific of what we advise you about. In fact, there are a number of different offers that are aimed very specifically at different groups of people who in their view of which SMS loans they want, may be based on very different wills and needs.

Thus, there is always a SMS loan that suits you and your needs. Whatever they might look like. That is actually the case, thankfully.

Finally

When you apply for an SMS loan, there is a part you should consider. While the process itself is incredibly simple. The need for guidance through this is why we exist at all. We know what a hugely complicated process it can be. And how wrong it can also be if the loan does not go through as originally hoped for. It has some potential to put to it!

The most important thing is – and we believe this applies to most things in life – to get a good overview. Please take help from us. After all, that’s why we’re there! To help you get as good an experience as possible of taking a loan, without creating any problems for you on a later level.